How do the world's largest companies really stack up in 2023 when it comes to revenue?

In a year where the top 500 businesses collectively brought in a staggering $41 trillion, understanding which companies lead the pack can offer valuable insights into the global economic landscape.

This article delves into these corporate giants' influence, focusing on the top 10 companies by revenue and their significant role in reshaping economies worldwide.

What exactly are the leading companies by revenue for 2023?

Read on to discover the economic behemoths that continue to shape our financial future.

Largest Companies by Revenue in 2023: A Comprehensive Overview

In 2023, the top 500 companies amassed an astonishing $41 trillion in revenue. This monumental figure underscores the vast scale at which these corporate giants operate, driving economic growth worldwide. These companies span various sectors, showcasing the breadth and diversity of industries contributing to such a substantial economic output. The cumulative revenue not only highlights the power of these entities but also reflects their capacity to influence global financial trends.

The top 10 largest companies by revenue play a pivotal role in shaping the global economic landscape. These corporations are not merely contributors to their respective industries—they are leaders, setting benchmarks and driving innovation. Their operations influence supply chains, employment, and technological advancements across multiple sectors. As such, their financial performance serves as a key indicator of broader economic health and stability.

Focusing on the top 10 revenue-generating companies provides insight into the sectors leading the charge in economic influence. These firms are often at the forefront of technological integration, sustainability efforts, and consumer trends. By analyzing their revenue streams, one can gauge which industries are currently thriving and which are poised for future growth. The dominance of these companies underscores their strategic importance in the global economy, underscoring their role as economic powerhouses.

Top 10 Revenue Leaders of 2023: Industry Dominance

In 2023, the world's largest firms by sales include industry giants such as Walmart, Amazon, and Apple. Walmart stands at the forefront with an impressive $648 billion in revenue, solidifying its position as the leader among the top earning companies. Amazon follows closely, generating $575 billion as it continues to expand its global e-commerce and cloud computing empire. Apple, known for its innovation in technology, amassed $383 billion, reflecting its strong consumer base and product demand. These figures underscore the substantial economic impact these corporations have, not only in their respective industries but also on a global scale.

The dominance of these companies illustrates their pivotal roles as economic pillars. Walmart's extensive retail operations drive significant employment and supply chain activities, impacting economies worldwide. Amazon's reach extends beyond e-commerce, shaping the digital landscape through its cloud services. Apple's influence in the technology sector is unmatched, driving advancements in consumer electronics and setting trends in digital innovation. The top 10 companies by revenue are not only leaders in sales but also in shaping industry standards and consumer expectations, reinforcing their status as fiscal powerhouses.

| Company Name | Revenue (in billions) |

|---|---|

| Walmart | $648 |

| Amazon | $575 |

| Apple | $383 |

| Company 4 | Revenue 4 |

| Company 5 | Revenue 5 |

| Company 6 | Revenue 6 |

| Company 7 | Revenue 7 |

| Company 8 | Revenue 8 |

| Company 9 | Revenue 9 |

| Company 10 | Revenue 10 |

Regional Analysis: Revenue Contributions by Country and Continent

When examining the leading corporations by revenue, the United States and China emerge as the major revenue generators. In 2023, the U.S. leads with a staggering $13 trillion in corporate revenues, reflecting its robust economic infrastructure and diverse industrial sectors. China follows closely with $11.2 trillion, showcasing its rapid industrial growth and expanding global influence. These figures highlight the economic prowess of these two nations and their significant roles in driving global financial trends.

North America's contribution to corporate profitability is equally notable. The region leads with $1.18 trillion in profit, underscoring its strategic economic position. This profitability is fueled by a combination of technological innovation, a competitive business environment, and a strong consumer market. The financial performance of North American companies not only reflects their operational efficiency but also their capacity to adapt and thrive in a dynamic global marketplace.

Sector Insights: Profitable Industries in 2023

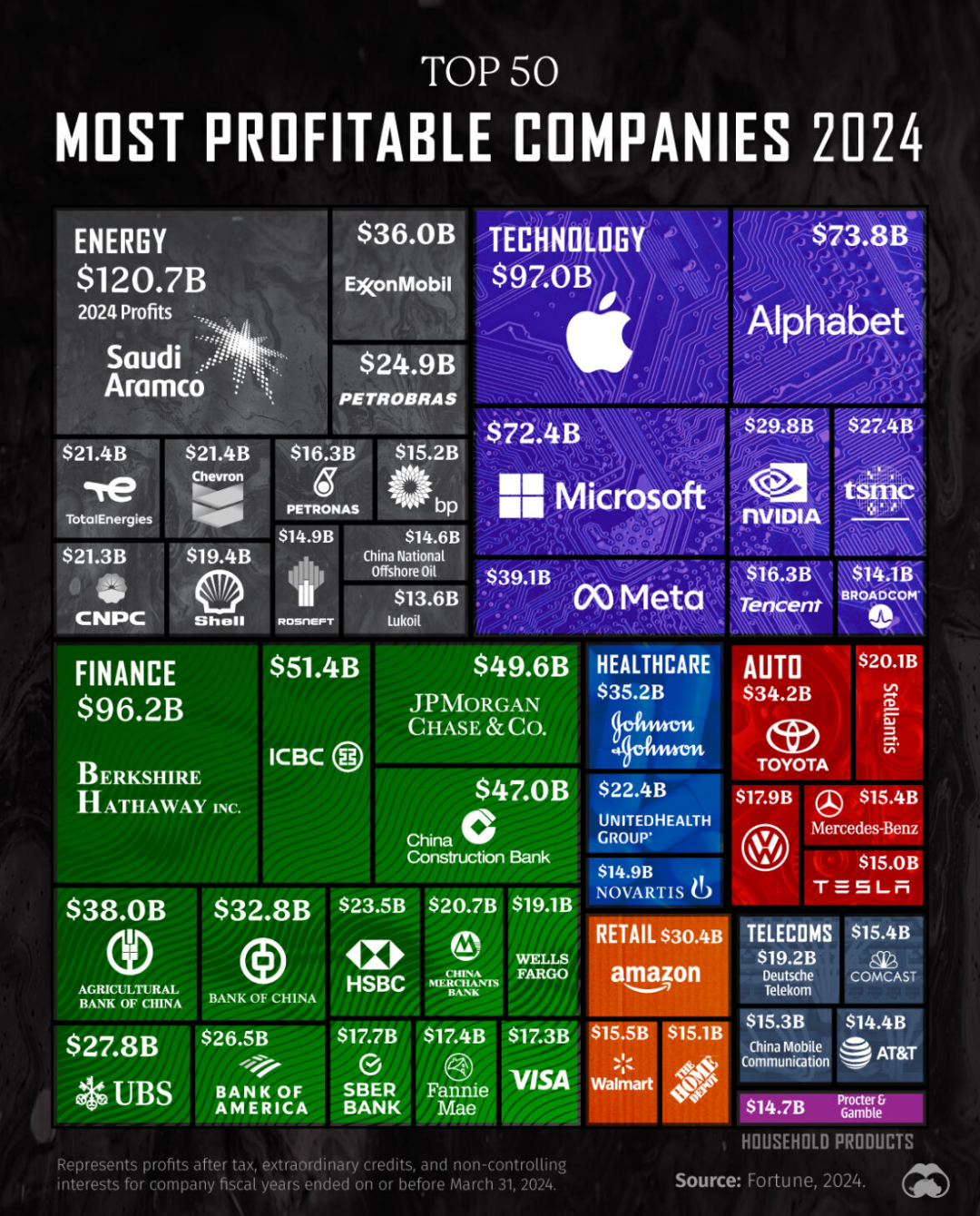

In 2023, the highest revenue companies were concentrated in a few key sectors, with Energy, Finance, and Technology leading the charge. These industry titans together accounted for a remarkable 63% of the total global profit, highlighting their substantial impact on the global economy. Each sector plays a unique role in shaping market dynamics, with Energy driving essential resources, Finance managing monetary flows, and Technology pushing innovation boundaries.

The Technology sector has emerged as a dominant force, particularly in the United States. This sector's influence is evident as tech giants continue to innovate and expand, driving not only economic growth but also societal advancements. Companies within this space are at the forefront of digital transformation, cybersecurity, and artificial intelligence, setting trends that other industries follow. The U.S. tech market's competitive edge lies in its ability to foster startups and support tech behemoths in scaling operations globally.

Energy and Finance, while distinct in their operations, both significantly contribute to the global economic landscape. The Energy sector remains crucial, adapting to sustainable practices while meeting global energy demands. Meanwhile, the Finance sector underpins economic stability, facilitating investments and managing risks across industries. Together, these sectors ensure the steady flow of resources and capital, essential for sustaining economic growth and supporting the operations of other industries worldwide.

Comparing Profits and Losses: Financial Performance of Top Firms

In 2023, the fiscal powerhouses demonstrated their financial prowess, with the top 10 most profitable companies collectively earning an impressive $689.8 billion in profits. These companies, spread across various industries, have leveraged strategic operations and market dominance to maximize their earnings. Their ability to navigate economic challenges and capitalize on opportunities sets them apart in the corporate revenue rankings.

- Company 1: $Profit 1 billion

- Company 2: $Profit 2 billion

- Company 3: $Profit 3 billion

- Company 4: $Profit 4 billion

- Company 5: $Profit 5 billion

Conversely, the 10 least profitable companies faced significant financial hurdles, culminating in a combined loss of $126 billion. These companies grappled with various challenges, including market volatility, increased competition, and operational inefficiencies. Despite their struggles, these firms continue to seek strategies for turnaround and growth, aiming to stabilize their financial standings in a competitive global market.

Revenue Trends and Economic Indicators: Understanding 2023's Market Dynamics

In 2023, top companies are significantly reshaping the digital landscape. How are they doing this? By leading in innovation and technology integration, these economic powerhouses are redefining industries. Companies such as Amazon and Apple are at the forefront, leveraging digital tools to enhance customer experience and operational efficiency. Their influence extends beyond technology, impacting supply chains and consumer behavior globally. As digital transformation accelerates, these firms set the pace for others, driving a competitive edge in the market.

Notable trends in 2023 include shifts in insurance and tariffs. How are these trends affecting the market? Insurance companies are adapting to digital platforms, offering customized products and streamlined services to meet evolving consumer demands. Meanwhile, tariffs have had a mixed impact, with some industries facing increased costs affecting profitability. However, companies are innovating to mitigate these challenges, exploring new markets and optimizing supply chains to maintain competitiveness. These trends highlight the dynamic nature of global trade and risk management in today's economy.

The energy transition and GDP size also play crucial roles in shaping economic indicators. How are these factors influencing the market? The shift towards renewable energy sources is prompting companies to invest in sustainable practices, reducing carbon footprints while gaining consumer trust. This transition supports long-term growth and resilience against environmental challenges. Additionally, GDP size remains a key indicator of economic health, with larger economies driving demand and investment. Understanding these elements is essential for navigating the complexities of the modern economic landscape.

Overall, 2023's market dynamics are characterized by innovation, adaptability, and sustainability. How do these factors interplay? Companies are embracing digital transformation to stay competitive, while adapting to global trends like insurance changes and tariff adjustments. The energy transition further underscores the move towards sustainable growth, aligning economic objectives with environmental goals. As these dynamics unfold, businesses must remain vigilant and agile, ensuring they capitalize on opportunities and mitigate risks in a rapidly evolving global economy.

Final Words

In 2023, the largest companies by revenue shaped the global economy with a staggering $41 trillion generated.

These financial giants not only dominated their industries but also redefined economic landscapes.

With Walmart, Amazon, and Apple leading the charge, their roles as economic pillars became more pronounced.

Regional analyses showed the U.S. and China at the forefront, while profitable sectors like Technology, Energy, and Finance led the way.

Understanding these dynamics offers valuable insights into the fiscal powerhouses shaping 2023.

As the economic landscape evolves, companies and individuals can navigate future trends armed with knowledge from this year's market leaders.